Wolves and Judges Part VI--Shepherds may lie.(No paywall).

The Making of a Quagmire by Debt ("Debenum")

Happy 𝝅 Day, welcome. Time to evince.

Expiscatory. [1605–15; ‹ L expiscātus, ptp. of expiscārī to fish out]:to find out by thorough and detailed investigation; discover through scrupulous examination.

You will hit a “paywall” in 5 minutes, where I offer a FREE 7-day trial to finish this investigative piece, there will be more to this story. You can cancel, or, stay a free subscriber. Forensic accountants and process servers are costly, but were needed. I’m all in on this series about debt, lies by omission, and lawyers. [Paywall deleted, this is too much fun to charge].

Free for subscribers Part X (“Nothing is more despicable than respect based on fear.”) will be released tonight at 6:31 pm. It’s an ending, a stop a long the way.

In Panta Rhei, Again, a preview of this column, that was published January 27, I wrote that “The riverbed changed,” which Katherine Hepburn exclaims, after wading in to a small shallow stream, in search of “Baby,” only to find herself over her head. Anything can change, in a second.

The Gul warned that trust ought to be earned over time, to be wary of attaching too quick. Not everyone who showers you with affection is earnest. Trust is earned; it is not a confident dive into the abyss.

Aretha sang it: “I'm gonna take all I can take.”

My Four Key Learnings over decades:

One, on lawyers: Lawyers, our shepherds, are people, too. Law degrees are earned by roughly the same percentageof neurotypical and neurodivergents, a few rogues too, the same as in the general population. We hypothesize that profession does not attract a disproportionate distribution of neurodivergents. Think bell curve.

Two, on debt: “Debt is a promise, equity is a hope,” —a fine man, a banker.

Three, on trust: “What, I should only trust good people? Man, good people get bought and sold every day. Might as well trust somebody evil once in awhile. It makes no more or less sense.” —Thomas Pynchon, Inherent Vice

Four, for some, lying is learned. For others, mendacity is their first language.

Learnings learned, here is the first back story. Bear with me.

First, are “lawyers are people too”? They are trustworthy, by definition. Because the Bar Association, fellow lawyers, says they are, until they are proved not to be. It is an assumption and judges sit on that same plateau.

NYS Supreme Court judges, are mostly elected by the voters of the judicial district in which they serve. Candidates do not run in primaries; rather, they are nominated by judicial conventions in their district, in a convoluted referral process where Judges of the Criminal Court of the City of New York, as well as the Family Court in New York City, are screened by the Mayor’s Advisory Committee on the Judiciary, which submits a list of qualified candidates, from which he makes the appointment. These slots renew, barring egregious behavior, on or off the bench. Yet, judges do not like being overturned, or criticized, by the Appellate Division.

Second, on “debt’s a promise and equity’s a hope.”

Most of us have some debt. Promises are made to be kept. Some overpromise and under deliver. Some promise and never deliver. Some make no promises and over deliver. Few have no debt, so their promises are not correlated with what they deliver.

Law is a business where lawyers charge clients hourly and pay a large portion in overhead. Law is also a “profession” with a business model. Cheaper labor, billed at dear rates, fix a high percentage of overhead at long term below market prices. Lawyers’ “salaries” or “draws” are best guesses based on year end profit projections. Larger firms, which can fix more of their expenses, and leveraging inexpensive post-law school labor hoping for future equity, are more durable business models than small practitioners’ Exceptions include Dewey & LeBoeuf and, earlier, Myerson & Kuhn.

All debtors strive to make payments time. We all manage lives, and lifestyles. Can you imagine a lawyer’s behavior not being changed if encumbered by too much debt?

Debt is a gun to the head of any small business, or any business with a tenuous business model. Debt is an unrelenting, unsaturated, unbreakable promise.

What about debt to the IRS? An IRS Tax Lien? A State Tax warrant? These are special debts, very public and expensive.

If you don’t pay or make arrangements to settle your IRS tax debt, the IRS can levy, seize and sell any type of real or personal property, and future earnings, too. The IRS interest rate is the federal short-term rate plus 3% and compounds daily. The interest rate recently has been about 5%.

How might unbreakable publicly filed IRS liens change lawyers’ tactics, salaried or hourly, their litigants’ ?They are difficult to earn, according to the statistics in the annual IRS Yearbook where in 2012, IRS filed 707,000 Federal Tax Liens, and 212,000 Federal liens in 2021, out of 162 million returns filed. One in 231 of 2012 filers are encumbered to the IRS-in 2012, alone.

Lawyers (and judges) are people, too.

So, in Centre Street you might find a few lawyers with federal, or state, tax liens. Invisible you say? The IRS files Notice of Federal Tax Liens, in order to alert creditors that the government has a legal right to your property. Yes, it’s public information, available to clients and the Mayor’s Committee, too.

A single encumbered lawyer might not be able to steer tactics, or rulings, or the pace of a trial, or settlement. But what of two? Three? What are the odds of having more than one lawyer in a case, having a lien?

Let’s look at the statistics in order to calculate the odds—which have no predictive value:

Liens filed in 2012. Remember 1/231, in the general population.

One lawyer on a case: 1/231= 0.43% Three lawyers on a case: 1/231 x 1/231 x 1/231= 1/12,326,391=YDM (“you do the math”)

What are the statistics of lawyers on one case ALL having Federal or State tax liens? YDM.

My response: “Lawyers are just people. too,” YDM. Or, draw a hasty conclusion:“Where there’s smoke, there’s 🔥.”

Sometimes paying attention to the smell, and direction of the smoke, leads you to the fire. “If, then” statements point to fires, they do not reveal the origin. One ought not to jump to a conclusion because of the classic “hasty Conclusion” or “jumping to a Conclusion” fallacy.

Multiple lawyers on a case, over leveraged? Conjecture? Correlation with future behavior? Causative?

Aretha knew that there is always more. End of first backstory.

To continue reading, please consider sampling a paid subscription, with a 7-Day Free Trial. This also gives you free access to the full posted archives. Free subscriptions continue outside the continuing “Wolves and Shepherds” investigative series.

Subpoenas go to ler@substackinc.com. This link takes you to the subpoena guidelines and the physical address for Substack where my copyright resides.

In Part “Z” of the Supreme Court of the State of New York, it is statistically easy to successfully motion to redact and Judge Debenum will bless it. Most Judges will do so “out of an abundance of caution.” The Judge, like many judges, an ex-prosecutor, knows how to mask exculpatory evidence and how best to introduce inculpatory information.

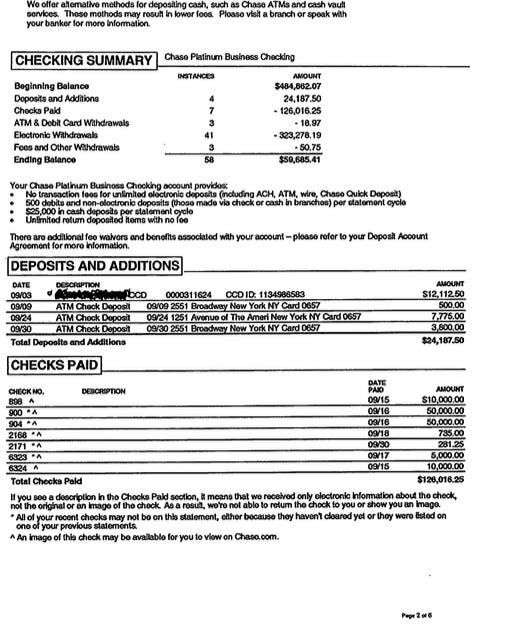

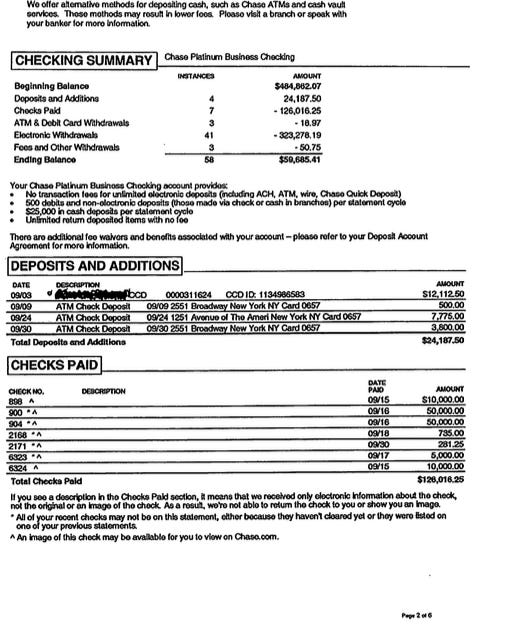

Yet Judge Debenum allowed an un-monied Plaintiff to subpoena monied Defendant’s Business checking account. Just checking.

Paywall removed here.

Interestingly, Judge Debenum had already “closed discovery” earlier— in 2005. Yet, upon Plaintiff discovering the illegal refi, it was never disclosed by Defendant, or her lawyer who was paid from proceeds, Judge Debenum signed and issued the Plaintiff’s subpoena to the Defendant’s personal bank records for the deposited cash Refi proceeds, showing the flow of funds form the mortgagor, to the Defendant’s business—without any gaps in provenance. No adverse inference was issued to Defendant.

A subpoena was signed after “discovery was closed.”

Plaintiff motioned Defendant’s business was marital asset as “commingled” funds from a post-divorce home refinance where Defendant used proceeds for a startup, and he moved to declare pre and post marital assets had been commingled. Judge Debenum’s “Referee,” after studying the motion for five months, then losing the motion, and being supplied a second copy, denied the “commingling”motion despite checks written from the Refinanced home directly deposited in the startup’s account and written to Defendant’s business partner. Wait.

However, Judge Debenum allowed redactions of client identities because she wanted to protect the monied Plaintiff from the un-monied Defendant hurting the asset that he wanted to own a share of—to shoot himself in the foot, or head, right? Judge Debenum knows well the gap between “exculpatory” and “inculpatory.” Or, does she?

Lawyers can be innumerate. Especially, ones with tax liens— because how else would they get the tax liens if they were numerate?

How can business expenses have client information? Unless the business is repeatedly reimbursing clients’ fees— and a successful one business does need to do that too often, right?

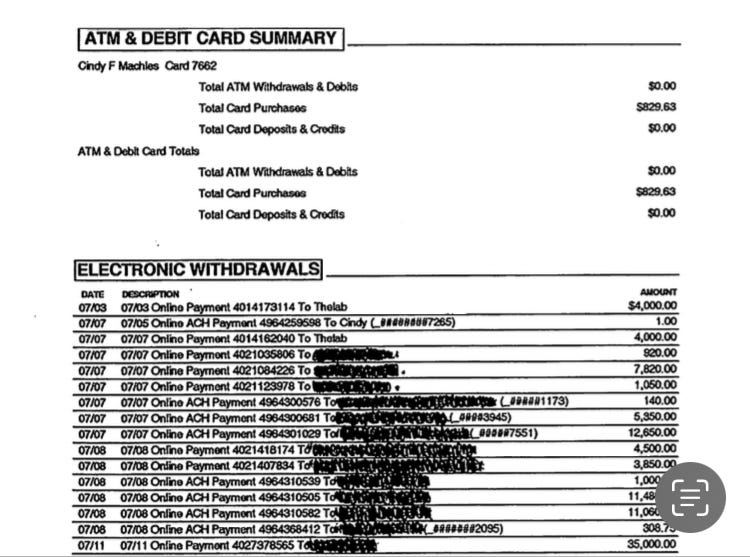

Yet Defendant’s lawyer pre-emptively redacted expenses, too. A lot of them. Most of them. See an example page, below. Presumably, the expense redactions are wire transfers, or overseas SWIFT transfers (wait for it) blackened with squiggly circular pen marks, not professional redaction software. But, the rest? To whom?

More.

Defendant issued checks, visible in the hundreds of pages redacted, or transferred, over $2MM each, to two third parties, one a “corporate barter" company, and also to Defendant’s business savings account, both unnamed in the subpoena issued by Judge Debenum to Defendant on behalf of Plaintiff. Remember, the Judge was a prosecutor and is expert at finding evidence of malfeasance.

Judge Debenum’ mission is protect the chain of evidence, but from who? Redacted expenses total in the millions including $2,800,000 to ICON International, a “corporate barter” company and $2MM to her savings.

Also, $964 to Marc Kasowitz’s law firm, Only $964? Marc Kasowitz, the firm’s founding and managing partner, has been described by CNBC as the “toughest lawyer on Wall Street” and by Bloomberg Financial News as an “uberlitigator.” Marc Kasowitz was the personal outside attorney for U.S. President Donald Trump retained to represent Trump personally in connection with investigations into the role of Trump's presidential campaign in Russian interference in the 2016 United States elections. Marc Kasowitz/$964/Bargain.

Why only $964?

That’s a $964 question. The Kasowitz law firm is likely numerate, and profitable. And, on $964 in business with Defendant?

Redacted expenses, with no client information total exceed $5 million. Payments to “corporate barter firm ICON International

total $2,800,000. Transfers to Defendant’s business savings total $2,100,000, both circumvent the intent of the subpoena. Defendant provided no accounting for the $4.9MM of un-redacted cash transfers to these two accounts. Where did the cash go? Cash wires also can be hard to follow without a well worded subpoena.

Unknown checks on this page alone total $126,000. Over a year, a multiple of this amount.

On the Defendant’s personal 2016 Form 1040 she expensed $50,000 in legal fees providing neither the Court, nor the IRS, with any copy of the legal expense billing description, possibly to Marc Kasowitz’s law firm, or not, incurred on unknown dates for unknown personal, or business, legal purpose. $50,000.

Why all the interest in redacted expenses? Here, is a peek:

In 2018, Defendant told Judge Debenum, and Judge Debenum believed her, that Plaintiff had crashed her business, by “badmouthing” her, and as a consequence her AGI, and revenues had declined from over $1MM in 2016 to negative in 2017, (when Defendant also just happened to file her 1040 as Single, another story.)

This, while the Plaintiff had claimed (the “commingling” motion later denied by Judge Debenum) that Defendant’s business was a marital asset having been started with capital from an illegal, undeclared 2012 Refi. Also, personal Checks, from Defendant’s hidden Refi proceeds from the home, were issued to Defendant’s business account and directly to her business partner.

No objections, so far, to the expense redactions, from Plaintiff’s counsel either. The unknown has the Law of Unintended Consequences; or, all lawyers are innumerate.

Is there more in the redacted expenses of Defendant’s bank statements that could be inculpatory to Defendant? Or, to other parties in Judge Debinum’s Part? Why did Defendant’s lawyer redact certain expenses if there is no Defendant client information? There ought to be nothing of any value in the expenses, to either party, no matter intent. Right?

Why did Defendant’s lawyer redact any of the bank statements’ expenses ? Why no objections from either Counsel or Judge Debenum? Why spend only $964 on the prestigious Kasowitz law firm? Or is there more to the $50,000 legal invoice prior to Defendant’s revenues declining to zero in 2017? What was the $50,000 in 2016 personal legal fees spent on? How did Defendant become “Single’ in 2017? Declaring a loss, blaming it on the Plaintiff? What happened to the business after 2017? Did Defendant get divorced unilaterally? Where did the $4.9MM of funds transferred to Savings and ICON International ultimately flow to? What is “Corporate Barter?” and why is Defendant’s health care advertising firm sending the lion’s share of it’s revenue stream to a private company specializing in trade credit? What happened to the cash?

You cannot remember, from Wolves and Judges Part [III], yet to be published, on the subject of Automatic Orders meant to protect unmonied spouses, that this same lawyer, Defendant’s counsel, was paid $10,000 from an undeclared Bank account that received just over $100,000 cash proceeds of a 2012 illegal Refinance by Defendant that Judge Debenum declined to enforce the Automatic Orders when Defendant’s surreptitious refinancing was exposed in 2016 only because Plaintiff subpoenaed the newly discovered mortgage. Defendant’s lawyer is a private man. Maybe a little embarrassed to be paid from the same hidden kitty used to make Bar Mitzvah gifts to Defendant’s niece and seed his client’s new business.

Wait, I omitted to tell you something, before the paywall.

Defendant’s lawyer incurred a Federal Tax Lien, between $25,000 and $50,000 (exact amount is public) in the same year Defendant refinanced the marital home and cashed out $100,000, which she deposited in an undisclosed NYC based bank account and continued to not disclose it, until Plaintiff did a document search on the marital home, and then a background check on Defendant’s counsel.

Unethical research, you say? Public information. And, a lie by omission is a lie. When you discover a lie, by a lawyer, what do you do with it? Crime exception? When confronted, by subpoena, Defendant disclosed. Involuntary disclosure years after the fact. What’s the crime? Cash disappears ever day, but recall the Defendant linked the disappearance of her 2017 AGI, and a great deal of revenue, to Plaintiff’s “evil tongue” (LaShonHara).

What did Judge Debenum do after Defendant confessed in a submission to the Court to the illegal refi? One that paid down 25% of her lawyer’s IRS tax lien? The Judge listened, yet issued no admonition, no sanction, no order to stop looting the estate, or unwind the past encumbrances and looting.

Judge Debenum in 2015, had already closed “discovery” for Plaintiff without ever enforcing the Automatic Orders. There are exceptions to closure. Yet the Defendant waited to transfer assets until after Discovery was closed—solely for Plaintiff. Unilateral closure of plaintiff’s discovery by Judge Debenum. Did Plaintiff’s counsel argued against, without success.

Does this bear repetition?

Or, allowing any discussion of the looting, encumbrances, or transfer of $4.9MM assets out of Defendant’s business, the same period Defendant reported a loss on her 2017 “Single” 1040, claiming Plaintiff “badmouthed” Defendant. Skip two paragraphs down to the Second Back Story

Defendant’s lawyer, and defendant, never disclosed to the Plaintiff, or the Court the 2012 “cash out” mortgage on the encumbered asset. There was no “negative inference” issued.

Empowered by non-enforcement of the Automatic Orders by Judge Debenum Defendant started her business with looted assets, paid her lawyer’s fees, and then looted or encumbered, a further $28,000 cash out refinancing in 2020. And, more.

Encumbered or looted assets accrue a handsome statutory credit to Plaintiff—a piggybank of forced savings. The statutory interest, 9.00% accrued monthly, far exceeds the principal stolen, the total principal and interest on encumbered and looted assets will exceed $1MM by next summer. Judge Debenum knows the principal amount because she asked for an accounting in 2016, now outdated. The compound interest on the principal might surprise Judge Debenum. Or, it might not. She is educated. And numerate.

And Judge Debenum then allowed the redaction of Defendant’s expenses. As did both parties’ counsel.

Here is the Second Back Story:

Judge Debenum blessed this:

Recall, Defendant’s 2017 AGI on her “Single” 1040 plummeted to negative from over $1MM in 2016, the year after she deducted $50,000 in undisclosed legal fees on her 1040, when she told the IRS she was divorced, and filed SINGLE—because Plaintiff "badmouthed” her business to “clients.”

Defendant has never supplied an Amended 2017 1040.

Defendant told Judge Debenum that Defendant had crashed her business, by badmouthing her, all the while Plaintiff claiming (a motion later denied by Judge Debenum) that Defendant’s business was a marital asset having been started with capital from an illegal, undeclared 2012 Refi. Checks issued to Defendant’s business account and to her partner attest. What was the $50,000 in legal fees spent on?

Who were the “clients” Plaintiff bad mouthed Defendant’s business? The same business he wanted a share of?

See “Wolves & Shepherds Part VII,” coming soon.

Two steps back. Filler needed. It’s a screenplay. Some of this is a “flashback.”

One, lawyers are not taught “How to redact” in law school. One ought to use redaction software, or a thick black pen, not a sharpie or a pencil. Two, Defendant, refinanced the marital home in 2012 and deposited $100,000 “cash out” in a local TD Bank branch which Plaintiff found on the “StreetEasy” Documents section. The TD Bank checking account showed up in the required Defendant net worth disclosure 2 years later, after Plaintiff subpoenaed TD Bank, after checks from the TD account were used to the lawyer, cash was invested, court documents show, in Defendant’s startup business checking account, partner reimbursed for “startup expenses,’ expert witnesses hired for the trial, and Defendant’s niece received a Bat Mitzvah gift—all disclosure found by Plaintiff’s researcher, not disclosed Defendant.

We know that revenue disappeared. We know Defendant is SINGLE. We know she encumbered the marital home, in order to pay her lawyer and started a new business with the loan on the home. We know Judge Debenum said:”no, it’s not a marital asset.” No new 1040s and corporate returns provided by Defendant since 2017, or an Amended 2017 return. Objections you say? Crime exception you say?

Where is the crime?

Where did the Defendant’s revenue disappear to in 2017? From the Defendant’s business, that is not a marital asset which Plaintiff allegedly “bad mouthed,” but also wanted Judge Debenum to declare a marital asset subject to equitable distribution? Recall, Judge Debenum declined to declare the asset commingled. Then what is the point of pencil thin redactions?

Moreover, I have withheld publication of a redaction badly executed also missed that shows a Middle East wire transfer by Defendant’s business to Gulf Bank in Kuwait. Gulf Bank? Kuwait? Why not the Bahamas? You can fly a private jet there and not even show a passport. Why not Switzerland where Defendant’s BFF was a senior executive at Credit Suisse, then HSBC (Luxembourg)? Much better vacation spots in Kuwait. Or, Switzerland. The transfer of funds to Gulf Bank in Kuwait, was poorly redacted by Defendant’s attorney yet it was meant to be redacted. So, until Judge Debenum un-redacts it, an we received advise not to display it.

Undeclared un-redacted bank records could possibly show, upon request by Plaintiff, or the IRS, that Defendant had legal foreign bank accounts she had not, and has not yet, disclosed to the Court when she claimed in 2017 that Plaintiff had “badmouthed” her business causing revenue declines. The IRS requires all Foreign Bank Accounts require annual filing of Form FRB 114. Remember Treasury prosecuting Swiss Banks called Credit Suisse and HSBC? Un-redacted bank statements would also show legal expenses to the Kasowitz law firm, and other law firms, but a direct explanation of a $50,000 personal legal expense in the middle of a battle over Plaintiff’s role in the decline in value of an asset he believed to be funded by marital funds seems a bridge too far.

I forgot, Treasury provides a loophole.

Foreign Banks Account (“FRA”) owners, including owners of IRA's, must file “FRB 114” disclosure forms annually—IRAs too. Compounding offshore is a reason many, now retired PE GPs have offshore IRAs. Responsive IRA Trustees, like HSBC (Luxembourg) and Credit Suisse, operate in the Bahamas. All legal.

The Department of the Treasury likes off ramps. If an individual is not the owner of record of the account they can say, to the Court, then they do not own a FRA. But, can they? Yes.

Even if the offshore account is legal, even if the FRB 114 forms have been filed annually, even if the six year window for filing for amnesty for NOT filing FRB 114 forms has not expired.

STOP. Let me catch my breath from all the “ifs.”

Then, if legal, why not declare the post-divorce assets domiciled offshore to the Court as Judge Debenum has immunized Plaintiff’s business from equitable distribution? Recall—Defendant accused Plaintiff of hurting her business. It resulted in a bad karma with the Judge because her role is to protect litigants from financial abuse. Remember, she was a prosecutor.

This stands. Until an IRS Whistleblower petition is filed, or multiple petitions. Or, it stands until counsel persuades Judge Debenum on the reversal of expense redactions, the cash trace to dispel Defendant’s “evil tongue” motion, or the parties settle, out of court, masking the flow of funds and legal fees, forever.

Here is a redacted reunion photo of Defendant with grad school classmates, including, the former (in 2018) Treasurer of CSFB (Zurich), now a senior executive with HSBC (Luxembourg). It is unknown if FRAs need to be opened in person, in Europe, or the Middle East or the Bahamas. Or, by e mail and wire/SWIFT transfer too. Or, over coffee.

They did not teach redaction well in my graduate program, either.

I only have more questions, to be continued, in Wolves and Shepherds Parts VII-X, and maybe looking back in Parts II-V, too.

I said, “Law degrees are earned by roughly the same spectrum of neurotypical and divergent as in the general population.” Maybe, not.

Why did Debenum know to close discovery in 2015 yet never enforce Automatic orders before then?

Why would Plaintiff badmouth a business he sought to own part of in a Commingling Assets motion?

Who were the “clients” who claimed Plaintiff badmouthed Defendant?

Why did Defendant’s lawyer redact expenses?

What do the masked expenses hide?

Where is the missing $2MM wired to Savings?

How was the $2.8MM sent to ICON International disbursed?

What do the Corporate revenues look like after 2017? The 2017 Amended 1040X and the 1040 and1065 Corporate returns from 2018 to the present look like? Where did the revenue come from?

Were legal offshore entities filed? Offshore IRAs Switzerland? Luxembourg? by Defendant or Trustees?

Were FBAR 114s filed timely? Six year amnesty for filing 2017 FBAR. 114 ran out?

Are there more Federal and State tax liens lurking in this Part?

Has either party had past undeclared issues with the IRS?

Has Defendant contacted the IRS? Treasury? NYS AG?

Have the parties settled?

The Gul. Always, listen to him. Even that voice in your head, saying:

Remember, “There’s always more,” &.

My Odessa redhead Grandma Min’s chicken soup chock full of carrots, celery chicken chunks and an occasional sweet potato always tasted better after simmering for a day, or two.

It’s not soup, yet

Read Part X, a shocking new development, when it drops at 6:13 pm, tonight. It is 90% free.

©Philippe du Col 2023